IRS Tax Refund 2026 Schedule: As the 2026 tax season begins, millions of Americans are getting ready to file their federal tax returns and are eager to know when their IRS tax refund will arrive. For many households, a refund is an important financial boost used to pay bills, reduce debt, or cover essential expenses. Refund timing depends on how and when you file, the credits you claim, and whether your return is processed without issues.

Understanding the general IRS refund schedule for 2026 can help taxpayers plan better and avoid unnecessary worry during the filing season.

When the IRS Will Start Issuing Refunds in 2026

The IRS is expected to begin accepting federal tax returns in late January 2026 for income earned during the 2025 tax year. Once your return is accepted, refunds are usually issued within about 21 days if you file electronically and choose direct deposit. This is the fastest and most reliable way to receive your money.

Taxpayers who file paper returns or request a mailed check should expect a longer wait. Paper returns require manual processing, which can delay refunds by several weeks.

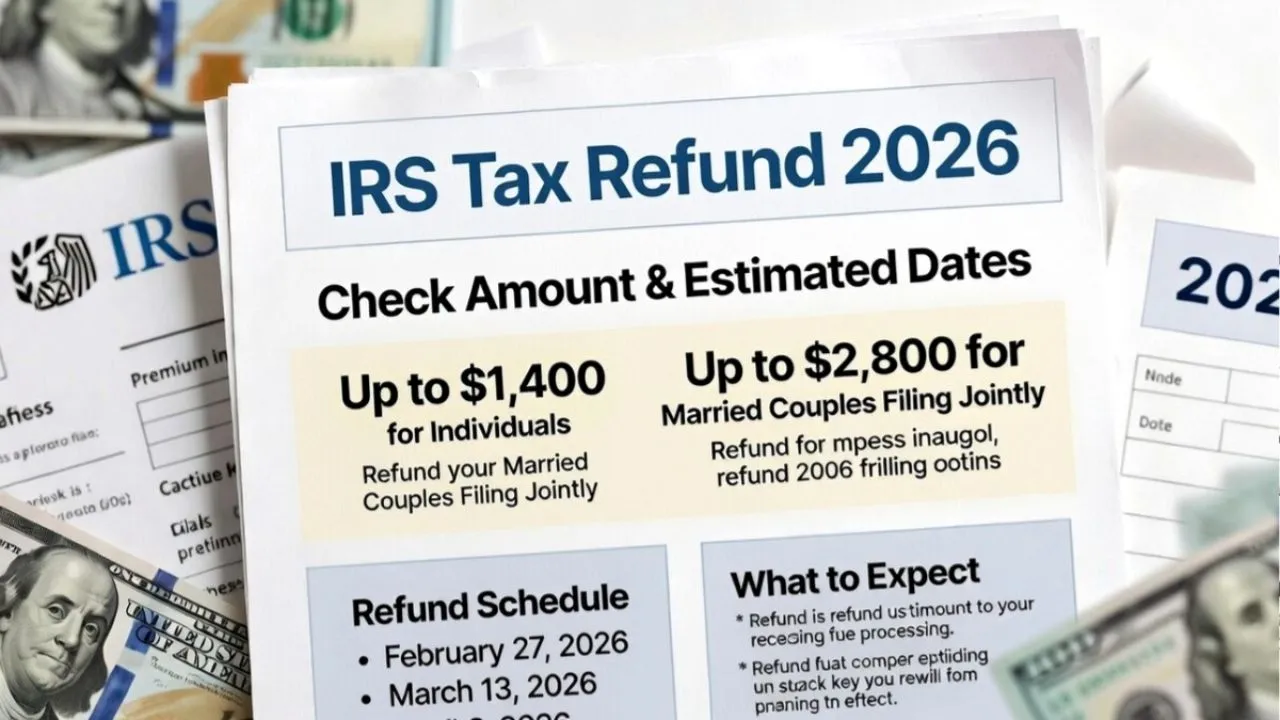

Estimated IRS Refund Timing for 2026

Refund timing generally follows a familiar pattern each year. Returns filed in late January may receive refunds in early February, while those filed in February often see deposits by mid to late February. March filers usually receive refunds within March, and those who file close to the April deadline may receive refunds in late April or early May.

These dates are only estimates. Individual refund timing can vary based on processing speed, filing accuracy, and IRS workload.

Why Some Tax Refunds Are Delayed

Even early filers may experience delays in certain situations. Refunds that include the Earned Income Tax Credit or the Additional Child Tax Credit are legally held until at least mid-February. This rule applies even if the return is filed as soon as the IRS opens.

Other common reasons for delays include errors on the return, missing information, identity verification checks, or suspected fraud. Filing electronically and reviewing all details carefully can help reduce these issues.

Average IRS Refund Amount in 2026

The average federal tax refund in 2026 is expected to fall between $2,800 and $3,200. However, refund amounts vary widely depending on income, tax withholding, filing status, dependents, and credits claimed. A larger refund usually means more tax was withheld during the year, not that you paid less tax overall.

How to Check Your IRS Refund Status

Taxpayers can track their refund using the IRS “Where’s My Refund?” tool. To use it, you need your Social Security number, filing status, and exact refund amount. Refund status updates are typically posted once per day.

The IRS tax refund schedule for 2026 follows a predictable pattern for most taxpayers. Filing early, choosing direct deposit, and submitting an accurate return are the best ways to receive your refund quickly. Staying informed and checking your refund status through official IRS tools can help make the tax season less stressful.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund timelines, rules, and average refund amounts may change. Taxpayers should consult official IRS resources or a qualified tax professional for advice specific to their situation.